-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(5C): 1-5

doi:10.5923/c.economics.201301.01

A Qualitative Findings of Tax Compliance Burden: Analysis of Tax Preparers Survey

Noor Sharoja Sapiei, Mazni Abdullah, Kamisah Ismail

Faculty of Business and Accountancy, University of Malaya, Kuala Lumpur, 50603, Malaysia

Correspondence to: Noor Sharoja Sapiei, Faculty of Business and Accountancy, University of Malaya, Kuala Lumpur, 50603, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study focuses on qualitative analyses of the compliance burden of Malaysian corporations from the perspective of tax preparers. Three main areas are investigated, namely, tax-related difficulties faced by companies, reasons for engaging external tax preparers and suggestions on how to reduce tax compliance burden of companies. There are a number of features in the corporate income tax system that may affect the compliance requirement of taxpayers. Some of the features that are within the control of the tax authorities include the tax administration aspects, such as education and taxpayer services, along with the tax design aspects such as tax exemptions and incentives. Based on the qualitative analysis the following measures are laid out from the perspective of lowering compliance burden: (i) improve on the accountability and transparency in tax administration matters, (ii) simplification of tax incentive requirements and (iii) convergence of tax law with accounting standards in order to reduce discrepancy and tax adjustments.

Keywords: Tax Compliance Burden, Qualitative Analysis, Tax Preparers

Cite this paper: Noor Sharoja Sapiei, Mazni Abdullah, Kamisah Ismail, A Qualitative Findings of Tax Compliance Burden: Analysis of Tax Preparers Survey, American Journal of Economics, Vol. 3 No. 5C, 2013, pp. 1-5. doi: 10.5923/c.economics.201301.01.

Article Outline

1. Introduction

- The World Bank administers worldwide comparisons on the cost of doing business, comprising the cost of remitting and collecting taxes on an annual basis. The report addresses the taxes and mandatory contributions that companies must remit or withhold in a year of assessment, together with measures of administrative burden in complying with tax regulations. In the World Bank Doing Business 2008 Report on the Paying Taxes indicator, Malaysia ranks 56th among 178 countries. The research study and corresponding data are accessible at http://www.doingbusiness.org. Based on this information, a study into the compliance burden of corporate taxpayers is timely and necessary.

2. Principles of a Good Tax System

- The theoretical recognition of tax compliance burden has been identified in the early eighteenth century by Adam Smith[1], in his famous work on the ‘Wealth of Nations’. The book which was published in 1776 suggested a set of principles also known as the canons of taxation for a good tax system. The author proposed that a good tax system is one that satisfies four principles:(i) Principle of EquityThis principle states that a tax system should be fair among taxpayers and taxes should be levied in accordance with ability to pay. A good tax should be proportional to income so that the burden of supporting government is in accordance to benefits received from government. In the words of[2], p. 416:“The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state.”(ii) Principle of CertaintyAccording to this principle, a good tax system should ensure that taxpayers are clear on their tax compliance obligations, such as the amount of tax that is payable, the method of payment and the deadline for payment. In[2], p. 416], he remarked:“The tax which each individual is bound to pay, ought to be certain, and not arbitrary. The time of payment, the manner of payment, the quantity to be paid, ought all to be clear and plain to the contributor, and to every other person.”(iii) Principle of ConvenienceThe principle of convenience implies that the time and mode of payment of a tax should be the most conducive to taxpayers. In Malaysia, the scheduled monthly tax deduction and e-filing are among the examples of convenience in terms of timing and manner of payment. In the words of[2], pp. 416-417:“Every tax ought to be levied at the time, or in the manner, in which it is most likely to be convenient for the contributor to pay it.”(iv) Principle of EfficiencyThe principle of efficiency is achieved when the cost of administering the tax system is not being excessive. In[2], p. 417, he recognised these characteristics when he wrote:“Every tax ought to be so contrived as both to take out and to keep out of the pockets of the people as little as possible, over and above what it brings into the public treasury of the state.”Three of these principles of a good tax system, namely, certainty, convenience and efficiency emphasised the impact of tax operating costs on the tax system[1]. Tax operating costs represent the total of tax administrative and compliance costs. Tax administrative costs are the costs incurred by the revenue authorities in the taxation process while compliance costs are the costs incurred by taxpayers in meeting the requirements of the tax system[3]. According to[4], the principle of efficiency includes both tax administrative and compliance costs, while principles of certainty and convenience are concerned wholly with compliance costs. The three principles necessitate compliance costs to be negligible, in order not to violate the principles of a good tax system. In the context of these principles, the lack of certainty in tax legislation and inconvenience prevalent in a tax system, would expose taxpayers to unnecessary predicament and oppression, thereby increasing their compliance burden[5, p.29]. In[2], p. 417, he recognised this problem when he wrote:“..... forfeitures and other penalties which those unfortunate individuals incur who attempt unsuccessfully to evade the tax, it may frequently ruin them, and thereby put an end to the benefit which the community might have received from the employment of their capitals.” In addition, a psychological burden in terms of stress and anxiety, may be imposed on taxpayers as legislation requires them to carry out complex obligations under the threat of legal penalty[6]. In[2], p. 418, he remarked:“ ..... subjecting the people to the frequent visits and the odious examination of the tax-gatherers, it may expose them to much unnecessary trouble, vexation, and oppression; and though vexation is not, strictly speaking, expense, it is certainly equivalent to the expense at which every man would be willing to redeem himself from it”.Due to changes in economic activities and functions of the government since the Adam Smith era, a few additional principles of taxation, have been introduced by the modern economist. In[7], pp. 207-208, the authors summarised the major important principles of a good tax system:§ The distribution of the tax burden should be equitable. Everyone should be made to pay his or her ‘fair share’.§ Taxes should be chosen so as to minimize interference with economic decisions in otherwise efficient markets. Such interferences impose ‘excess burdens’ which should be minimize.§ Where tax policy is used to achieve other objectives, such as to grant investment incentives, this should be done so as to minimize interference with the equity of the system.§ The tax structure should facilitate the use of fiscal policy for stabilization and growth objectives.§ The tax system should permit fair and non-arbitrary administration and it should be understandable to taxpayer.§ Administration and compliance costs should be as low as is compatible with the other objectives.These updated and extended canons of good tax practice emphasised more on the impact of tax compliance burden on taxpayers caused by the interferences and arbitrariness in the tax system[7].

3. Literature Review

- Studies on estimation of tax compliance burden were conducted mainly in developed countries, especially in the UK (see[8];[9];[10];[11];[12];[13]), the US (see[14];[15]; [16];[17]) and Australia (see[18];[19];[20];[21]). To date, there is at least one study conducted in each country in the Organisation for Economic Co-operation and Development (OECD) countries, for example[22] in Canada, and[23] in New Zealand.Studies on corporate taxpayers’ compliance burden in the advanced economies, have many important contributions. Apart from establishing many of the measurements and conceptual issues in estimating burden of tax compliance costs, two major findings have emerged from these studies:(i) compliance burden increase with complexity in the tax system, and(ii) it comprise a significant share of tax related costs, either measured in absolute money terms, as a percentage of income tax revenue or as a percentage of GDP.Studies in the emerging economies however are not well established due to lack of experts in the area of tax compliance burden[24]. The limited studies include[25] in Brazil,[24] in Slovenia, [26] in Croatia and[27] in India. In Malaysia, a review of literature revealed three published compliance burden studies. First,[28] conducted studies on Malaysian PLCs, and second study by[29] on Malaysian SMEs. Both of these studies were conducted before the introduction of SAS. The third study by[30] was conducted after the introduction of SAS, utilising corporate SMEs as respondents. Findings from these studies, concluded that the compliance burden are relatively low as compared to the countries in the advanced economies.

4. Research Method

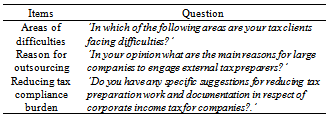

- Responses from external tax preparers were sought in this study. Some companies may not have an in-house tax compliance department but instead outsource all their tax activities. Therefore, valuable information may be obtained from a survey of these professionals who handle the tax affairs of large companies. The tax preparers sample was drawn from the list of tax agents from the IRB’s website. As this study requires responses on tax fees incurred by PLCs, externals tax preparers who are attached to or have been attached to accounting firms with large companies as their tax clients, were deliberately selected. According to[31], a sample may be purposively selected based upon its ability to address the questions being asked in a study. By utilising this sampling, a total of 185 external tax preparers from the tax agents list of the IRB’s website were identified for this study.The questionnaire for this study adopted items which were developed by existing studies (see[10],[17],[30],[32]). The open-ended questions elicited external tax preparers’ views on areas of difficulties, reasons for outsourcing, and measures to reduce compliance burden of the Malaysian income tax system (Table 1).

|

5. Research Analysis

- All responses to open-ended questions were analysed using content analysis. Content analysis is a systematic, reliable and replicable technique for condensing many words of text into fewer content categories based on explicit rules of coding[34].

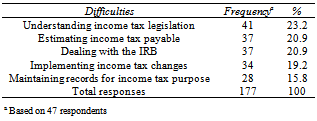

5.1. Tax Difficulties Faced by Corporate Clients

- The tax preparers were requested to identify the areas where their tax clients encountered difficulties in complying with tax requirements (Table 2).

|

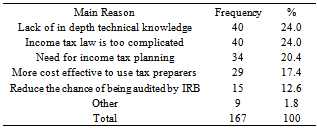

5.2. Reasons for Engaging External Tax Preparers

- The views of tax preparers were also sought concerning the reasons as to why their tax clients were utilising external tax services. Five main reasons for companies to engage external tax preparers are listed in Table 3. Respondents were also allowed to select more than one reason listed in the questionnaire.‘Lack of in depth of technical knowledge’ and ‘Income tax law is too complicated’ were the most stated reasons with 83.3 percent of cases. Tax preparers also considered the need for income tax planning (70.8 percent), costs effectiveness (60.4 percent) and reducing the chances of being audited by IRB (31.3 percent), as among the reasons for engaging their services. Other reasons (18.8 percent) that were brought up by the external tax preparers included the need for independent expert opinion on certain specific areas and to secure representation before tax authorities.

|

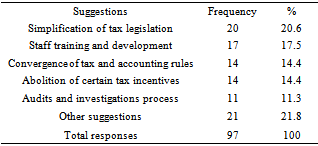

5.3. Suggestions to Reduce Compliance Burden

- Apart from the findings analysed so far, external tax preparers were given an opportunity to recommend measures to lower compliance burden of their tax clients. A large diversity of suggestions received were analysed using content as summarised in Table 4. Forty-three external tax preparers provided feedback to the questionnaire.

|

6. Conclusions

- This study provides qualitative analysis on tax-related difficulties faced by companies, reasons for engaging external tax preparers and suggestions in reducing tax compliance burden of companies. With respect to the research findings, this study makes several contributions to the body of knowledge. Mainly, the findings in this study enhance the current literature on tax compliance burden with regards to qualitative findings. Practically, the qualitative findings arising from this study provide valuable information for policy makers in the area of taxation, as well as to the taxation profession and the management of companies. Measures taken in relation to simplification of the tax system are expected to ease the burden in terms of compliance burden of on taxpayers. The findings of this study have contributed to the body of knowledge on tax compliance costs qualitative issues in the context of companies. However, as a piece of research, this study is not without its limitations and may represent opportunities for future research. As the number of responses was quite low (49 responses), a limited quantity of data was used in the content analysis. Thus, the findings of these external tax preparers’ surveys are considered as tentative. However, the qualitative responses received from this limited number of respondents are considerable and very informative.Given the findings and limitations of this study, there are several avenues for future research directions. This study utilised open-ended question based onresearcher-administered survey responses of external tax preparers. Future research should consider conducting in-depth interviews with tax preparers. These approaches are useful in providing a deeper understanding and explanation of the findings. The use of case studies may provide better quality responses on measures to reduce tax compliance burden. It would also be valuable to gain the views of other stakeholders, especially the tax authorities, on the various aspects of tax compliance burden addressed in this study.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML